Detailed Zakat Information

Donate NowWhat is the Principle of Joinder of Acquisition in the Same Class during the Lunar year?

The general principle is that one year must elapse over the Zakat-able property in order to render it liable to Zakat. This is subject to a qualification: where a person has Nisab of a particular class of Zakat-able property and during the course of the Zakat year acquires property of the same class from any source whatsoever, then the property so acquired is added to the existing Zakat-able property of the same class and Zakat is payable on the whole, or the remainder thereof, at the end of that Zakat year without calculating a separate Zakat year for each such separate acquisition. For example, a person has cash of $5,000 and during the course of the Zakat year receives a further sum of $10,000 by way of a gift. He must pay Zakat on the sum of $15,000 at the end of that Zakat year and a new year would not be calculated in respect of the subsequent acquisition of $5,000.

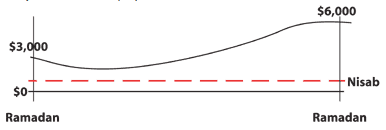

In this graph, $3,000 is the amount of wealth owned in Ramadan. This amount exceeds nisab (calculated according to the nisab of silver.) During the year it decreases but does not go below nisab. In this case, Ramadan will be counted as the beginning of the relevant lunar year and Zakat will be due on the amount of wealth in possession during next Ramadan, which is $6,000.

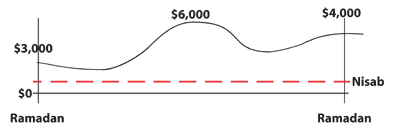

In this graph, $3,000 is the amount of wealth owned in Ramadan. This amount exceeds nisab. During the year the amount decreases, then increases to $6,000. Then, wealth decreases again before increasing to $4,000. Despite these fluctuations, the amounts do not go below nisab. Hence, the relevant Zakat year will begin in Ramadan and Zakat will be due on the amount of wealth in next Ramadan, which is $4,000.

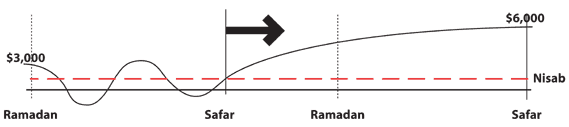

In this graph, $3,000 is the amount of wealth owned in Ramadan, which exceeds nisab. During the year it fluctuates – sometimes going below or above nisab. The individual’s relevant lunar year however only begins once the wealth goes above nisab in the month of Safar and remains above that for one complete year until next Safar. Hence, Zakat will be due in Safar on the complete amount, which is $6,000.

To read more about detailed information on Zakat, click here…